We all know that filing our taxes is a pain. But, the problem is even more complicated when you live in Australia because it seems like there are so many different forms to fill out and you have to pay for certain things that other countries don't charge for.

However, as tedious as this process may be, it's still your duty as an Australian citizen to file your taxes on time every year. If you don't think you should have to pay someone hundreds of dollars just so they can prepare a simple form that could take you hours upon hours to complete yourself - then we've got good news!

It is important to file your income tax return on time. However, not everyone has the know-how or experience to do this themselves. If you are looking for cheap individual tax returns online Australia is a great place to start! This article will show you how easy it is to find an affordable service that can help with all of your needs.

Ultimate List of the Best Cheap Individual Tax Returns Online Australia

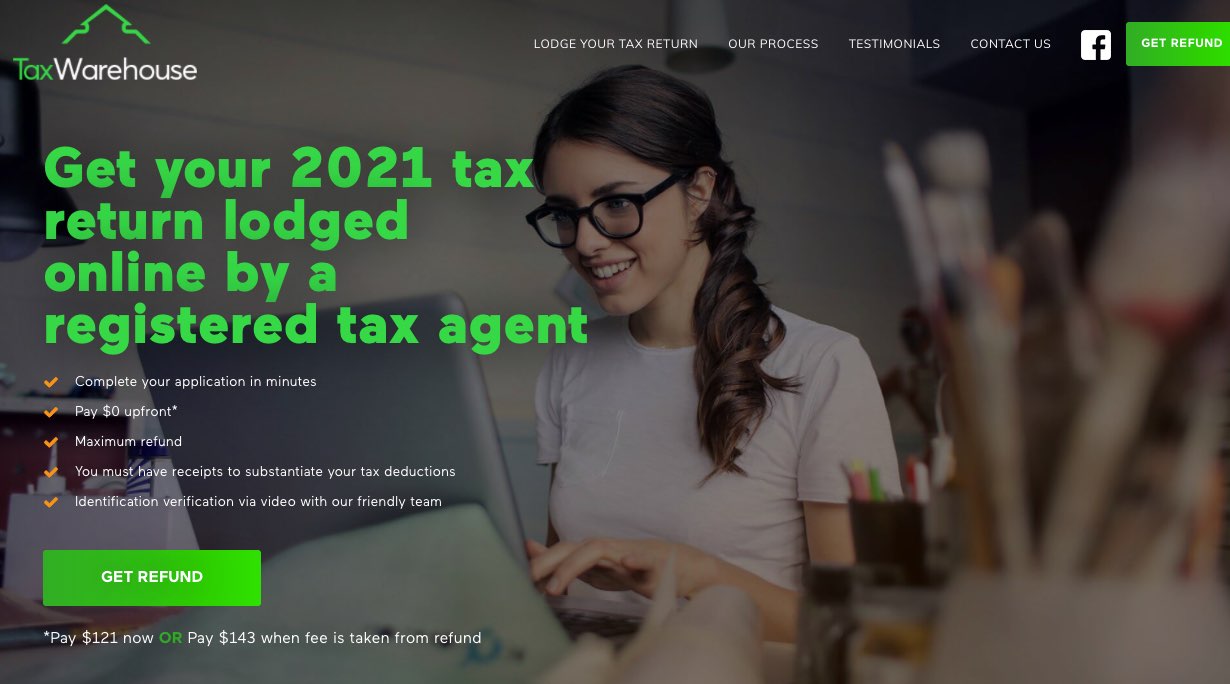

Tax Warehouse - Individual Tax Returns Online Australia

0407 418 209

Save valuable time and money

Lodging your tax online can be done at any time, from the comfort of your home. We pride ourselves on being honest and transparent, so you rest assured you won’t be hit with any hidden costs or hefty fees.

The Online Tax Accountants You Can Trust in Australia

Do you dread completing your tax return every year? Well, now you don’t have to! Here at Tax Warehouse, we make the process of submitting your tax return easier than ever, we do it for you!

Our service is fast and simple, allowing you to find an experienced tax agent online and have your tax refund completed and processed as quickly as possible and it can all be done from your mobile phone.

The tax agents at Tax Warehouse submit your tax return online for you.

Their proven experience in claiming the most deductions that return the highest possible tax refund based on your industry. We give you the confidence knowing your return is in the safe hands of fully qualified and registered tax agents. We maximise your return amounts and minimise the work on your end, so you don’t have to dread tax season any longer, and can use that tax refund money a little sooner!

Tax Window - Individual Tax Returns Online Australia

0401 117 311

Tax Window employs an award-winning approach to taxation, setting them apart from typical accounting firms. Their comprehensive services extend beyond the scope of traditional tax agents, offering expertise in various financial areas such as investment accounting and business enhancement.

Unlike many tax agents who charge exorbitant fees for their services, Tax Window takes a different approach. They believe in simplifying the taxation process, providing clients with understandable solutions that are tailored to their specific needs. Moreover, Tax Window stands out by offering industry-leading fees for its exceptional services.

One of the key aspects of Tax Window's service is its focus on delivering personalised tax strategies to each client. As a boutique tax practice, their team of tax agents pays special attention to individual clients, ensuring that their tax strategies are carefully crafted to minimise tax payments.

For those seeking investment planning assistance, Tax Window is a reliable partner. They possess unique insights into the Australian tax code, allowing them to develop strategies that keep their clients ahead in the financial game.

Business owners can also benefit significantly from Tax Window's expertise. The team understands the challenges of managing a business and the burden of compliance-related tasks. By entrusting Tax Window with their accounting and taxation needs, entrepreneurs can free themselves from the hassle of number crunching and focus on the growth and success of their ventures.

Tax Window's award-winning approach to taxation goes beyond the norm, offering exceptional services that cater to the diverse financial needs of its clients. Their dedication to providing understandable solutions at competitive fees sets them apart as a reliable and trusted partner in the complex world of taxation and financial management.

Express Tax Back Australia

1800 739 739

Our closely guarded "express tax back system" is intended for backpackers, travelers, and students who want to get the biggest tax refund possible in the shortest amount of time.

Don't be alarmed. To obtain all required documents, our "document recovery team" will contact your employer and government agencies on your behalf. It is an entirely free service.

If you are leaving Australia, you can have your tax refund deposited into your Australian bank account before you leave.

Are you working until the very last minute? Allow our office to organize the paperwork before you complete your work. The paperwork will then be collected from your employer, and we will arrange for your tax refund and super refund.

Because our clients come from all over the world, we focus on them rather than on Australia. In addition, we offer the best refunds, the simplest documents, and the lowest prices. But wait, there's more!

We have over 21 years of experience and provide the Guaranteed Refund Service. Tax refunds can be deposited directly into any bank account. You can't go wrong in any country!

Astro Accountants Individual Tax Returns Online Australia

07 3180 3161

Simply put, the people we interact with, the environment we create, and why we help are at the forefront of our business. Astro's team is dedicated to assisting people in becoming better money managers, both in business and as investors. As a result, we believe that if you are financially secure, you are more likely to help others, pass on your knowledge, and live your best life.

If it's time to get your finances sorted once and for all, then it's time to get a professional involved. Your accountant will work with you, reviewing your structure, cash flow, and profit to ensure you are meeting your business obligations. Deal with an accredited firm that has great communication with quick response times.

Tax is one of your most expensive expenses, and missing a lodgement deadline can wreak havoc on your finances. We offer strategic advice to businesses, trusts, SMSFs, and property owners. We can assist you in restructuring your affairs so that you meet your ATO obligations, reduce your risks, and pay the least amount of tax.

Maurer Taxation Individual Tax Returns Online Australia

0438 960 990

We specialize in taxation so that you don't have to. Individual tax returns, sole trader tax returns, company, partnership, and trust tax returns, as well as consultations and ATO representation, are all available.

Our tax accountant has extensive experience in all occupations and industries and knows what you can claim to get the best possible result at the lowest possible cost.

We are a locally owned and operated family business that is here to help you/your business. Our tax accountant is well-versed in rental investing, international taxation (expats), cryptocurrency, stocks/managed funds, capital gains tax, small business, and personal services income.

Frequently Asked Questions About Tax

You need to file a return if you're a: Single dependent under age 65, not blind, and any of these apply: Your unearned income was more than $1,100. Your earned income was more than $12,400.

Your tax return covers the income year from 1 July to 30 June. If you need to complete a tax return you must lodge it or engage with a tax agent, by 31 October. When you lodge a tax return you include how much money you earn (income) and any expenses you can claim as a deduction.

Amount of income tax refund corresponds to the excess tax that was paid by you, and thus not considered as an income. Hence, it is not taxable. However, the interest received over the income tax refund is considered as an income and is subjected to income tax as per the applicable tax slab.

Our average Australian tax refund is $2600. The amount of Australian tax you get back depends on a number of factors like how long you worked for, how much you earned and how much tax you paid.

How much can I claim with no receipts? The ATO generally says that if you have no receipts at all, but you did buy work-related items, then you can claim them up to a maximum value of $300. Chances are, you are eligible to claim more than $300. This could boost your tax refund considerably.

Mulcahy & Co. Individual Tax Returns Online Australia

1300 204 781

Accountants, tax professionals, and business consultants on the Sunshine Coast can help you achieve financial security. The qualified accountants and tax professionals on our staff will give you guidance on how to manage your finances wisely and move you one step closer to financial security.

Our accountants are skilled and knowledgeable business planners. We provide comprehensive business planning services, including expert advice and support in business development, business health checks, business succession planning, business startup, and strategic planning.

One more area where Mulcahy & Co Sunshine Coast excels is in providing individual taxation and accounting support. Our tax accountants are the best in the business, and we also assist clients in obtaining government benefits such as youth allowance and pensions. Do you require assistance with your ATO tax return? Call us right away.

East Partners Individual Tax Returns Online Australia

(08) 8362 3488

We're here to make a genuine difference in the lives of our clients. Providing a high-quality, efficient compliance service is only one aspect of this. The next logical step is to assist our clients in developing, improving, and growing their businesses. Our Business Development offerings are valuable and tangible services that provide clients with long-term value.

We extract the story that the numbers tell and explain it in simple terms so that you can understand it. We ensure that all required regulatory reporting is completed, but we also go deeper into the numbers and what they mean for the health of your business.

Our accounting and financial services are tailored to your specific needs. It could be as simple as a regular phone call to review business performance or setting aside a day to design the future of your company and map out the steps to get there.

We work with some incredible people and have built a network of skilled professionals. This means that all questions and concerns can be addressed, ensuring that you receive the best advice and service possible.

Q Tax Individual Tax Returns Online Australia

1300 047 829

Do you require an ABN or GST registration? Do you require assistance with your BAS? We can help you fill out all of the required registration paperwork and prepare your Business activity statements. Does your BAS match the financials on your tax return at the end of the year? If not, let our staff take care of the necessary reporting for you. Additionally, we will file your tax return for free if you have QTAX prepare your BAS.

Happy Tax Australia

07 4755 1111

The bulk of Centrelink payments, salary and earnings, investment income generated from rent, bank profits, or interest, company revenue, and capital gains from the sale of assets like stocks or real estate are all included in the category of income that is liable to income tax.