An accountant has one of the essential roles in any business, whether they work in large corporations or small businesses. As the financial backbone, they prepare and examine financial records, ensure all money transactions are accurate and pay taxes on time.

Located in Oakleigh, Victoria, and looking for an accountant? Look no further! To get you started finding an accountant, we’ve created an ultimate list of the best business accountants in Oakleigh, Victoria.

Ultimate List of Business Accountants in Oakleigh Victoria

EWM Accountants & Business Advisors Oakleigh

ewmaccountants.com.au | oakleighaccountants.com.au

03 9568 5444

EWM Accountants and Business Advisors are Chartered Accountants helping small business with their accounting, bookkeeping and taxation needs. Established more than 30 years ago, we are experts in helping small business and specialise in construction, investment, medical, dental and manufacturing industries. Based on busy Oakleigh in Melbourne, the firm is made up of a group of expert accountants who bring a wealth of experience to help fulfil our vision.

Why Choose Us

As specialist taxation and advisory firm, we don’t force round pegs into square holes. We build our procedures to fit your firms with specific requirements. Like to receive files by Dropbox®? We can do that.

Prefer to get old- fashioned correspondence by mail? Need bookkeeping or just payroll help in addition to accounting services? We can help. Need finance advice as well? Not a problem.

Business Accounting Services

We can relieve you and your team of the enormous burden of all your bookkeeping and accounting needs, including preparation of your annual accounts and periodic management accounts for tax, business appraisal, and planning purposes which also creates greater capacity internally so you can grow your business.

We will discuss your requirements with you and provide information relevant to your particular situation, as well as constructive advice, on a regular basis.

Accounting Services for Melbourne Businesses

We place a significant focus on building our clients businesses and profitability, as well as managing the demanding needs of complex compliance & regulation that businesses face. Our team of highly qualified accountants, bookkeepers, and financial strategists are fully trained and experienced locally to use best practice financial management disciplines to support your accounting and processing needs in Melbourne. Our streamlined policies and procedures ensure the outsourcing of your finance function is made easy whilst adding valuable expertise to your team and business.

We offer short and long-term solutions and fixed price agreements to support your business at any stage in its life cycle.

At EWM Accountants & Business Advisors, we aim to provide you with advice when your business needs it, not just when you ask for it. We help manage every aspect of your business and because we establish a one-on-one relationship with each of our clients. Our professional accounting advice is tailor-made for your business. In addition to the accounting services, we also provide business advice.

If any of the following is true, then we can help you with our world-class accounting services:

Business Accountants, you can trust

We offer a wide range of interrelated accounting and taxation services. With our end-to-end service, you’ll never worry about things falling through the cracks between your bookkeeper and accountant. Please consider us for your Melbourne Accounting Services. Rest easy knowing you’re supported by a team of caring and professional accountants. Come into our office for a chat, and we’re based at 63 Westminster St, Oakleigh VIC 3166.

Management & Tax Accounting

We stand in place of a full accounts department, but with zero hassle for you. You can relax with the knowledge that we’ve got covered, so you can focus on your business becoming the best version of itself you can imagine.

Tax Returns

Preparing and lodging all of your returns for both federal and state requirements to ensure tax time is a breeze year-round.

Strategic Accounting Advice

We review your existing operating structures and put tax-effective initiatives in place.

Accounting Protection & Planning

Comprehensive business services, asset protection, estate planning, and succession planning.

Financial Management

Effective tax planning and financial management to support the core of your successful business.

As specialist taxation and advisory firm, we don’t force round pegs into square holes. We build our procedures to fit your firms with specific requirements. Like to receive files by Dropbox®? We can do that. Prefer to get old- fashioned correspondence by mail? Need bookkeeping or just payroll help in addition to accounting services? We can help. Need finance advice as well? Not a problem. We will develop a service process that’s appropriate for your needs.

Hillyer Riches Business Accountants Victoria

(03) 9571 5333

We provide peace of mind for you and your business by delivering taxation, accounting bookkeeping, and advisory services in Caulfield East.

Looking For An Accounting Firm As Agile As Your Business?

Our Caulfield tax and accounting firm include:

- Chartered accountants.

- Tax specialists.

- Business & marketing advisors.

- Financial planners and wealth specialists passionate about your business and personal success.

From BAS/IAS and business/personal tax through to strategies to help grow your business, improve cash flow, enhance profit while protecting assets, and plan for succession. If you’re looking for more than just bean counters, then speak with our friendly team of tax and accounting advisors and check out our range of services.

Accounting

Our services include all aspects of tax accounting and planning, pre-30 June reviews, tax cost minimisation strategies, capital gains tax record keeping, BAS and IAS requirements, and cloud bookkeeping services. We will make sure you comply with all statutory requirements at both state and federal levels – it is our job, not yours, to keep up with all the legislation.

Quality Accountancy Services With Efficiency And Accuracy

Whether your accounting needs are complex or straightforward, personal or business based, working with experienced accountants can ease your compliance burden.

Our people have strong technical skills and understand that having an accountant who is reliable, responsive and understands your needs is what matters.

The less time you spend worrying about the back-end of your business means the more time you have to focus on the front-end – where your business intersects with your customers and where your products and services solve real problems and deliver real solutions.

With our systems in place, we can provide expert knowledge to assess your end-of-month financial statements and give you easily understood feedback on how your business is progressing.

Good Accounting Is A Game Changer Because It’s Not Just About The Numbers, It’s About Helping You Manage The Performance Of Your Business.

A team of highly specialised tax accountants within a firm established over three decades ago, and we offer quality accounting consultation in the Melbourne area. Learn more about us.

Based in Caulfield East, Hillyer Riches is a friendly, dedicated team of qualified accountants, business advisers and mentors for family-owned businesses.

With over 30 years of experience, we don’t just talk about theory, and we give practical advice that helps you achieve real results.

Whether you’re a startup with an innovative concept, establishing a new company, growing or consolidating your business, maximising your superannuation, or seeking the right advice about how to protect your investments, Hillyer Riches gives you an advantage.

Our accountants are trained experts in cloud accounting solutions and are able to provide advice and guidance on the adoption of the right technology to suit your business. As a partner with MYOB, Quickbooks & XERO, Hillyer Riches is able to review your needs and select the system that suits you best.

We’re Great At The High-Level Conceptual Stuff As Well As The Detail.

If you want us to, we’ll help you turn your vision into a finely honed plan. We enjoy brainstorming with you, scribbling down notes and coming back to you with a practical concept map of how to get to your goal.

We Know How To Run Our Own Business So We Can Help You With Yours.

We’ve been in business for over 30 years. Our experience growing our business means we don’t just talk about theory; we give practical advice that helps you achieve real results.

We’re Accountants. We Get Finances And Numbers.

We can read a balance sheet and P&L like a conductor reads a musical score. We can spot the core health, knowing where the cash has gone and how it should be used.

We Help You Get Your Business Model Right.

If you’re an early-stage investor, just starting your business from scratch or growing it to something great, our senior partners will learn what makes your business unique and help you manage cash flow and costs, learn business disciplines and avoid costly mistakes.

We’re Part Of Your Team.

We are a proactive accounting firm. We learn your needs and share your objectives. We’re dedicated to helping you grow and developing your business throughout the year. We’re always at the end of the phone and are happy to catch up over a coffee and a spreadsheet at any time.

We Help You Through The Tax And Regulatory Maze.

While tax and compliance may not be your highest day-to-day priority, neglecting them can create costly problems down the track. We find the right tax strategy (concessions and exemptions) so that your journey to business success is smooth and smart. Support from our specialists helps you start right and keep things right without the stress of uncertainty or the burden of doing it all yourself.

Hillyer Riches is a team of specialists with a real interest in your business. If that sounds like the kind of accountants you need, it’s time to take us up on a free consultation.

Bookkept Business Accountants Victoria

(03) 8568 3606

Bookkept are CPA qualified accountants and business advisors that provide quality professional accounting & business advisory to small & medium business clients.

We take care of small business compliance, bookkeeping & ATO issues. We’re specialists on Xero/MYOB & payroll on the accounting side and help with business process and systems to ensure you have the capacity to grow your revenue.

Tax & Business Accounting Services

Your end of year tax returns & financials is an undervalued part of your tax year. We make sure your financials are completed on time & correctly, and we are able to do this because of the focus we put on your books. We’re a small team of Chartered Accountants focused on giving you peace of mind. We offer a wide range of interrelated accounting and taxation services. With our end-to-end service, you’ll never worry about things falling through the cracks between your bookkeeper and accountant.

Bookkept is a cloud-based tax and business advisory firm located in Melbourne, servicing clients Australia wide. We offer a comprehensive range of accounting and business advisory services tailored to meet all accounting requirements across a wide range of industries.

We’re not just accountants, and we’re business people too. We know what it takes to start a company and risk it all to build a successful business. Our experience navigating the business world began with our involvement in respective family businesses and grew through over 15 years of combined experience in the tax and business services landscape.

Cliché as it may sound, we are not your typical accounting firm. After working in various accounting firms with clunky software, cubicles and excessive middle management, Daniel and Brendan came together with a clear vision of what a progressive accounting firm should look like. We’ve thrown out all of the stereotypes; timesheets, charge out rates and silly overheads to deliver innovative and actual value to our clients. Your typical accounting firm has all these things and then inadvertently passes these costs on to their clients through inflated bills that increase every year. We provide complete transparency when it comes to our fees. We charge for delivering a service, rather than running a clock.

Bookkept helps clients manage their cash flow and delivers continuous value by providing high-level visibility on business performance. Besides handling tax and bookkeeping matters, we provide true value to our clients by guiding them through their financial reports, enabling them to better understand how to control their growth and take opportunities further and higher. We keep in touch with our clients on a regular basis to ensure they are on top of their taxes rather than meeting with them once a year to discuss a big tax bill for a tax period that ended 9 months prior.

We walk our clients through the many accounting processes within their business structure and provide guidance and insights on tax planning and asset protection. We call this future-proofing.

There is no greater thrill for us than when our clients hit and/or smash their goals out of the park! We are dedicated to creating innovative and bespoke accounting solutions for our clients using a suite of cloud-based products to achieve a customised birds-eye view of their business and how it is performing. We practice what we preach too, and our office is completely paperless and cloud-based – we don’t even have a printer!

Our ability to pivot and problem solve sets us apart from our competition and empowers our clients to unleash their full potential.

Bookkept are CPA qualified accountants and business advisors that provide quality professional accounting & business advisory to small & medium business clients. We take care of ATO issues, Xero/MYOB & payroll on the accounting side and help with business process and systems to ensure you have the capacity to grow your revenue.

Tax Window Business Accountants

Tax Window, an esteemed accounting firm situated in Melbourne, is committed to assisting individuals and businesses in achieving their financial objectives. Employing a strategic methodology, they distinguish themselves by assigning client management specifically to senior accountants, showcasing a remarkable 30-year history of successful financial stewardship. Of particular note is their transparent pricing model, representing a deliberate departure from conventional fee structures prevalent in the accounting profession, ensuring clarity and fairness in financial transactions.

Services Offered:

- Strategic Planning for Investments

- Providing Small Businesses with Accounting Solutions

- Industry-Specific Services for Tradies, Startups, Builders, Medical Practitioners, Restaurants, Plumbers, Cafes, Bars, and Franchises.

- Guidance on Self Managed Super Funds (SMSF)

- Comprehensive Business Advisory

- Tailored Consultation for Properties

- Expert Services from Tax Agents

Contact Details:

Website: https://www.taxwindow.com.au/

Address: Level 1/441 South Rd, Bentleigh VIC 3204

Operating Hours: Mon-Sun 9:00-18:00 (By Appointment)

Phone: 03 9999 8538

Email: info@taxwindow.com.au

UTAX Accountants Victoria

(03) 9569 6913

UTAX Accountants is a place where "our focus is U." We are a modest business that values its clients and always puts them first. We are a Melbourne-based staff that is warm and approachable. Our office staff members are highly skilled specialists who will help you from start to finish. We individually follow up on requests to provide solutions that are unique to you or your company's requirements. You can choose from a number of services that UTAX can provide for Individuals, Businesses, Trusts, and Self-Managed Superannuation Funds.

You can get continuing help from our specialized bookkeeping services while you navigate the obligations of managing a business. UTAX Accountants are here to assist you in achieving your goals, no matter what they may be. We pay attention to you and take the time to understand your financial situation. 'U', after all, deserve the finest. We can help if you are looking for Accountants in Melbourne.

We endeavor to understand your needs, whether you are an individual or a sole trader. We strive to provide our clients with professionalism and customer service.

Rubiix Business Accountants Victoria

rubiixbusinessaccountants.com.au

(03) 9603 0067

We are a bright, aggressive, and enthusiastic accounting practice with substantial industry experience. Our clients come to us from all throughout Australia, New Zealand, and the world. We are extremely skilled and knowledgeable in all areas of taxation and corporate accounting. We collaborate with small and medium-sized family businesses, superannuation funds, various entity structures, and high-net-worth individuals. With strong client relationships, we develop all facets of our clients’ financial needs to achieve their goals and bring back the balance they want! Let Rubiix show you how we partner our clients to business & life success!

Specialists in Tax Compliance

Rubix Business Accountants are Tax Compliance Experts. We relieve you of the strain of regulatory compliance and make it easier for you to focus on building your business. We help all types of businesses with their tax obligations. Our motto is "lower your tax, higher your profit." So, utilizing our expertise, we will maximize any possible tax benefits or possibilities to assist you in meeting your financial objectives. We will ensure that your present accounting systems and procedures maximize smart decision-making while minimizing waste. We can train your employees to use your accounting software and empower them by teaching them effective accounting procedures. We will also verify that auditing needs are met correctly, and we provide a corporate compliance facility.

MAS Tax Accountants Victoria

1300 627 820

Accountants in Melbourne's Chinatown

Whether you are an individual, a business, or a corporation, our Melbourne Chinatown Accountants can assist you with all of your tax and accounting needs. Our highly experienced and efficient team is committed to providing comprehensive and dependable solutions to all of our clients in order to make your responsibilities easier to manage.

We not only provide value-added services and products to our clients, but we also have extensive knowledge and experience working with a wide spectrum of clients, from simple individual returns to complex partnership and corporate concerns.

In today's ever-changing business environment, our team of expert Accountants understands the complicated and demanding requirements that a small business owner encounters. Working with cafés, restaurants, contractors, information technology specialists, and family day care centers are just a few of our specialties. Furthermore, all of our employees are thoroughly qualified and keep up to date with all of the current tax regulations to ensure that all of our clients receive the finest possible tax advice and receive the highest refund possible.

SPS Business Consultants Business Accountants Victoria

03 9904 9260

Our trained Tax Accountants are experts in all aspects of business accounting and taxation, bringing years of industry knowledge to your taxation needs. We are dedicated to providing our clients with strategic and proactive assistance, and they have direct, personal access to our experienced team.

Services to Businesses

Client requirements for our business services are examined on a regular basis for planning purposes. We provide recommendations on areas where the firm is underperforming in comparison to the industry and remedies to any unforeseen surprises. We will prepare your company's accounting and taxation obligations, as well as offer assistance and guidance.

Business Advisory

We will assist you in implementing appropriate accounting systems such as Xero, MYOB, or Quickbooks. It will also allow us to see how your firm is going so that we can assist you in making proactive decisions to obtain the greatest results possible. Following that, as part of our service for effective tax planning and strategy, we will investigate the following areas.

Rogerson Kenny Business Accountants Victoria

(03) 9802 2538

Kenny Business Accountants is a dynamic company that is always evolving. They make large investments in information technology as well as the improvement of their processes and systems.

Rogerson Kenny in Melbourne is authorized to encourage business expansion. By applying cutting-edge technologies and quality assurance procedures, they constantly deliver high-quality work. Their clients are typically privately held, owner-operated enterprises with employees in need of tax, accounting, and business guidance.

Galley Associates Business Accountants in Victoria

0433 482 120

Galley Associates is committed to helping you identify and pursue the strategies necessary to create, protect, and advance your financial security on a personal and professional level. Our goal is to give you with good, rational, and customized financial solutions by carefully analyzing your financial needs in a courteous, knowledgeable, and professional manner.

Our top priority is to learn about you, your priorities, and your goals. It's not about a one-time service for our clients; it's about long-term financial goals and long-term preparation. We understand that everyone's finances are different and that the economic landscape might alter at any time, but we will do our best to keep up with these developments alongside you.

Maroulis & Co Business Accountants Oakleigh

03 9564 8447

CONSULTATION ON TAXATION

While taxation is only one aspect of your whole business activity, it is critical to properly plan and structure in order to obtain the best results today and in the future. Careful planning is necessary to meet your overall goals and maximize your wealth creation prospects, while a constant analysis of your situation is critical to ensuring the best outcomes as circumstances change.

BOOKKEEPING AND BUSINESS SERVICES

A wide range of accounting and business services are provided by Maroulis & Co., including successfully and affordably handling clients' compliance responsibilities. When a client's needs fall outside the purview of this division's services, the team works closely with a network of other experts to ensure that they are met.

Self Managed Super Funds are a tax-efficient way for clients to gain control and financial independence. In consultation with you and your financial planner, the experienced team at Maroulis & Co can advise and implement a solid superannuation structure, as well as provide ongoing administration and support to tackle the sometimes complex superannuation laws and provide the best financial outcome for you. Assisting customers in structuring their superannuation fund to allow for the effective purchase of property using the complex borrowing laws related to superannuation funds is one of our services.

Melbourne Tax Advisory Business Accountants Victoria

1300 942 239

We are your company's accounting staff. If you're just getting started, wanting to expand, or contemplating an exit strategy, we can help you get there. We at Melbourne Tax Advisory can assist you with a variety of taxation and accounting services. As qualified and skilled accountants, we collaborate with you to achieve your objectives while minimizing your tax liability. We have all of the knowledge and expertise required to manage your accounting and tax requirements. We believe strongly in technology and use cloud accounting software. We provide a streamlined and effective service to a wide spectrum of clients, from small start-ups to huge corporations.

ACCOUNTING FOR MANAGEMENT

It could be as easy as a phone call or as extensive as a monthly management meeting to discuss your company's success. The management service conducts a business health check to determine where things are going wrong, what needs to be improved, and how well the business is operating. This guarantees that your company is moving in the right direction.

Melbourne Tax Advisory is an accounting firm of business accountants situated in Port Melbourne, Mount Waverley, and North Melbourne that provides small business services to a variety of clientele. Melbourne Tax Advisory's directors have over 15 years of hands-on expertise in taxation and business consulting. Certified Public Accountants (CPAs), Chartered Accountants (CAs), and Tax Agents are among our members. We have the ability to find solutions that work for our clients and their businesses, as well as provide experience within the financial industry. We are deeply committed to assisting you in achieving your objectives. We respect customer connections and provide straightforward, honest counsel.

Etax Local Accountants Business Accountants Victoria

1300 174 680

Services to Businesses

Are you a solo proprietor or the owner of a small business? Do you spend too much time worrying about your company's finances? Time is a valuable commodity when it comes to running a business. There are never enough hours in the day to service clients, manage workers, chase down suppliers, and pursue business development. Adding keeping track of your business money to that list can leave you feeling as if you do nothing but work.

This is something our pleasant, client-focused team of small business tax specialists and CPA accountants are all too familiar with. It was the fundamental motivation behind the creation of Etax Local. A comprehensive collection of business services with no long-term obligations to lighten your load. The best business partner for you and your company. You keep your business functioning smoothly. We keep track of your finances. Our accountants have over 35 years of expertise and understand that no two firms or business owners are the same. We collaborate closely with you to ensure that we fully grasp your company's requirements and that we can assist you in realizing its full potential.

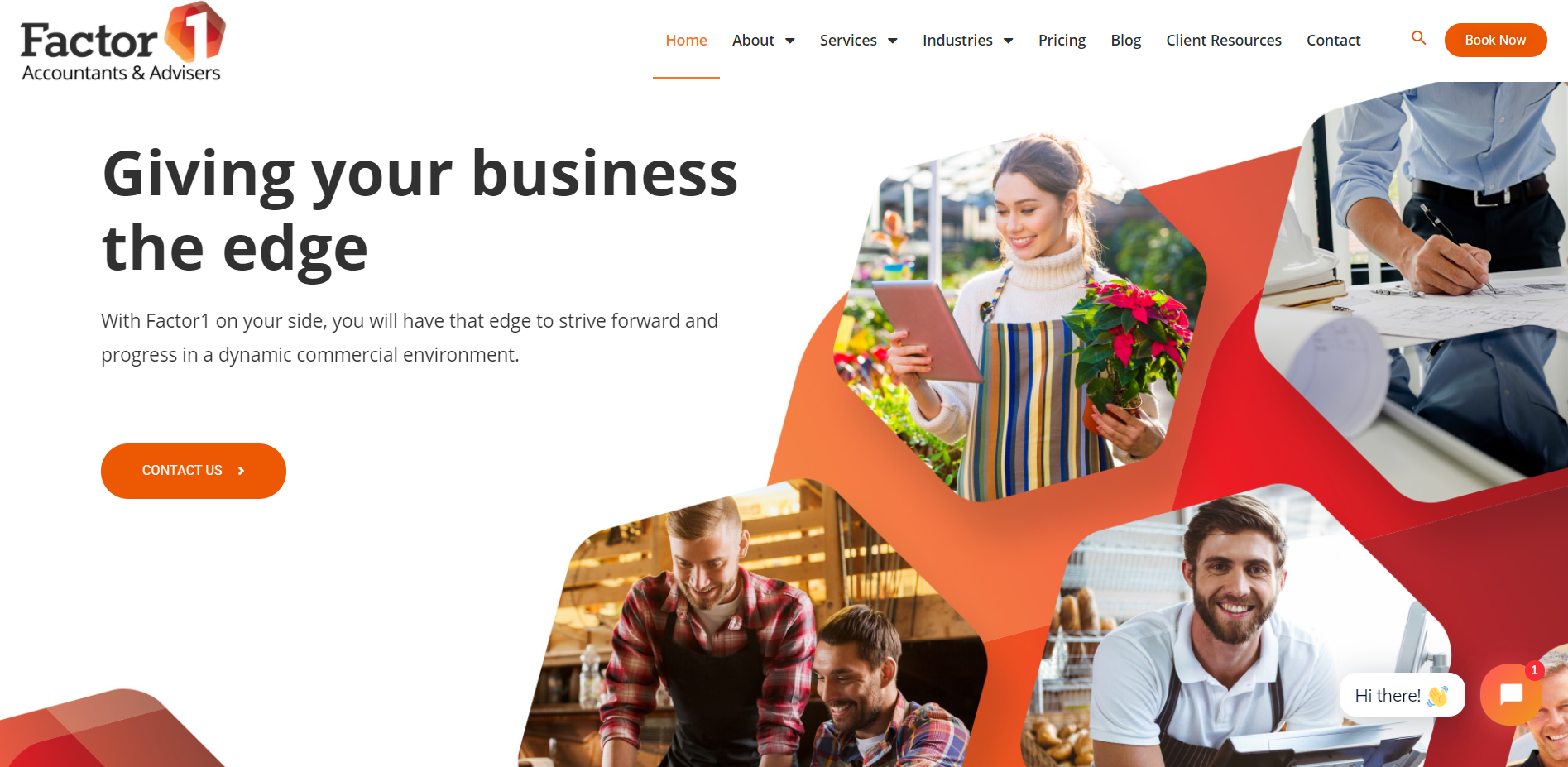

Factor1 Business Accountants Victoria

1300 886 300

Factor1 is a young and progressive accounting firm that provides first-rate financial services with excellent technical expertise and client interaction. Our accountants and business advisers are skilled and dependable, and you can count on us to constantly look out for you and your best interests. We are guided by a core set of values that has been critical to our success and is the foundation of everything we do. With Factor1 on your side, you will have a competitive advantage in a fast-paced commercial environment.

Taxation and compliance can be difficult and time-consuming. Allow us to supply you with crucial compliance services that are hassle-free, fast, and cost-effective. You know your business inside and out, so why not let us handle the portion of it that we know best? We concentrate on you and your company. We recognize that your business is unique, as are your requirements, and we build solutions that work particularly for you, tailoring solutions that will work best for both you and your organization.

MDB Taxation and Business Advisors Victoria

03 9349 1483

MDB provides accounting and management services to major private organizations and ASX-listed corporations, but it is equally delighted to offer big business knowledge to smaller firms and individuals. Frank specializes in tax planning and asset protection, and he has built a strong and skilled team of 20 people around him, making MDB a rare breed of accounting practice; one that can deliver services on par with the largest firms, but with the personal attention your business requires and deserves.

Please look over our services or contact us immediately to find out how MDB can assist you. MDB Taxation & Business Advisors has a long history of success for its many clients, dating back to 1997. MDB provides accounting and management services to major private organizations and ASX-listed corporations, but it is equally delighted to offer big business knowledge to smaller firms and individuals. Please review our service menu to the right or contact us today to find out how MDB can assist you.

Yarra Business Group Pty Ltd Accountants Victoria

03 9328 4721

ACCOUNTING FOR TAXES

YBG provides meticulous tax planning techniques to enterprises and individuals, assisting in tax responsibility compliance and optimization.

Our team stays current on tax legislation and regulations so that we can always provide the finest tax guidance to our customers. The key business skills and knowledge required for high performing workplaces, competitive advantage, and business success are provided by the Business Services YBG.

PROFILE OF THE COMPANY

Zelko Maric and Jim Tektonopoulos, seasoned accountants, founded Yarra Business Group (YBG) in 2005. The YBG team has over fifty years of combined financial services experience and is conveniently accessible in three locations. Our flagship office is in West Melbourne, a CBD periphery area within a short walk from Flagstaff Gardens. The Hawthorn office is located near the busy Glenferrie Rd.

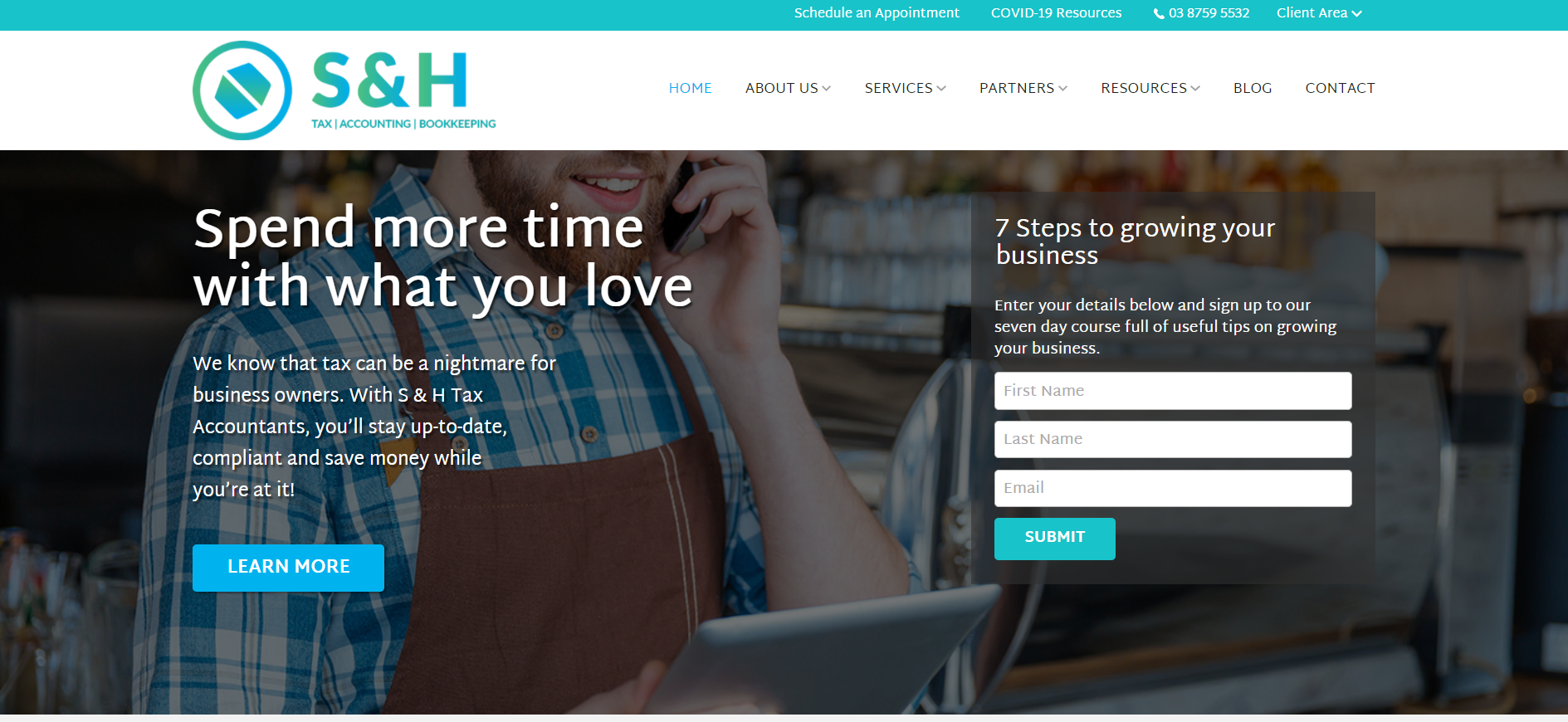

S&H Business Accountants Victoria

03 8759 5532

S & H Tax Accountants can help you move your business forward whether you've just begun or have been in operation for years. Our skilled team can handle your company's accounting, financial, and tax needs, as well as provide extensive business advise. We'll make certain that you have the tools, data, and insights you need to build your business without stress. Our goal is to make you feel good about your company and its future.

Numerous accountants disregard the person in favor of focusing on larger organizations instead (because they have larger finances!). S & H Tax Accountants do not operate in such manner. Parry and his crew collaborate with people from a variety of backgrounds. We want to provide you the ability to keep more money in your wallet.

Business Guidance

What do you think? We do more than simply accounting and tax! Yes, we're terrific at crunching numbers, but we'll also translate your data into simple suggestions. Parry and the S & H Tax Accountants team are based in Cranbourne and Chadstone, but we've helped businesses all around Australia grow and thrive. How can we assist you?

While we are pleased to work with all business owners as long as we are a good fit, we do have a specialty. Parry and his team have extensive expertise establishing company growth strategies for Medical Professionals, Construction Companies, and Hospitality Companies. Starting your own business is great, but what will you do about the money side? Most individuals strive to cut expenditures or have a strict budget in this manner, but there is rarely a better time to invest in the services of an advisor. We can help you get up and running quickly.

Success Accounting Group Victoria

03 9583 0559

We are known as the "Success" Accounting Group for a reason since our main goal is to help our clients thrive, and we offer much more than just the production of financial reports. Although we are much more than just a "traditional" accounting business or tax accountant, some clients contact us because they are looking for one.

Accountant for Taxes

We think that tax savings are the driving force behind the value we can contribute to your business and personal wealth at Success Accounting Group. We will work with you all year to answer all of your ongoing queries, and we will provide free email and phone assistance. All of these features will be paid for with a fixed charge agreed upon at the start of the engagement and paid on a simple monthly plan. Our clientele are determined and determined to succeed. We can help you generate wealth and grow your business, not just do your taxes.

We provide one-on-one property investment consultations for the clever property investor who wants a second opinion when buying or selling their property or investment. We have assisted hundreds of investors, ranging from first-time home buyers to advanced property developers, in making informed judgments. We can also assist you in obtaining pre-approval finance and selling your property. We have strong connections in the real estate business and can connect you with the best professionals to look after your valued investment.